China RMB Policy, Export Tax Rebate Changes, and Why Prices of Chinese Products Are Likely to Rise

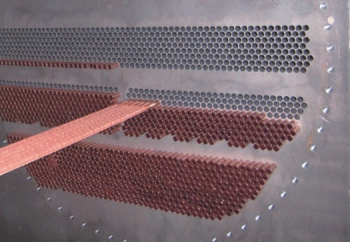

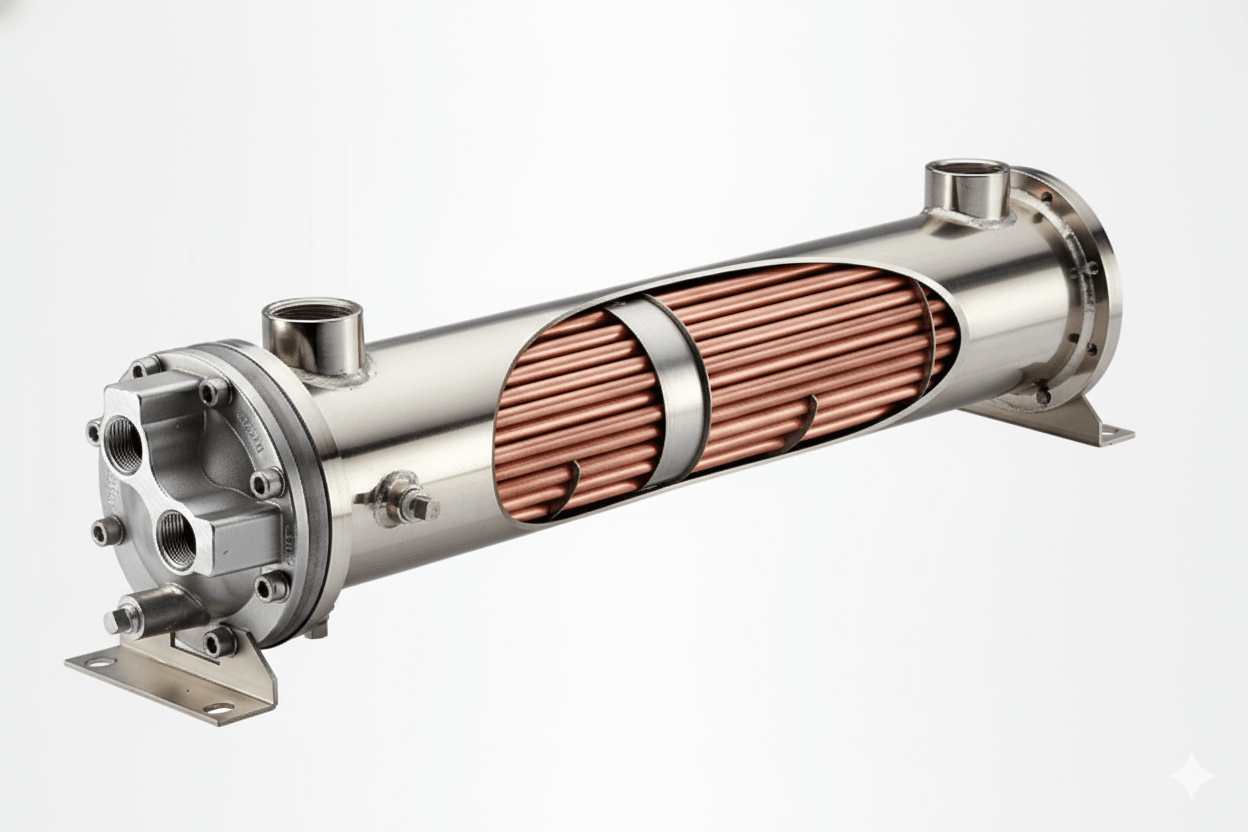

As global supply chains continue to adjust to economic uncertainty, China’s currency policy and export cost structure remain key concerns for international buyers. For industries sourcing finned tubes, copper fin tubes, and heat exchanger tubes from China, recent policy developments signal important changes ahead.

In recent months, topics such as the RMB exchange rate, export tax rebates, and rising manufacturing costs have attracted increasing attention from companies involved in HVAC systems, energy equipment, industrial heat exchangers, and related sectors.

A recent statement by the People’s Bank of China (PBOC) has provided important clarity on the direction of China’s exchange rate policy—and, when combined with upcoming tax policy changes, offers strong signals about future pricing trends for Chinese-made products.

China’s RMB Exchange Rate Policy Remains Stable and Market-Oriented

Zou Lan, Vice Governor and spokesperson of the People’s Bank of China, recently stated that China’s exchange rate policy is clear and consistent. The market will continue to play a decisive role in the formation of the RMB exchange rate, while authorities aim to keep the currency basically stable at a reasonable and balanced level.

He further emphasized that China is a responsible major economy and has neither the need nor the intention to gain international trade advantages through deliberate currency devaluation.

For exporters of heat exchanger tubes and finned tubes, this message is particularly important. It makes clear that future competitiveness will not rely on exchange rate movements, but on real manufacturing efficiency, product quality, and supply reliability.

Stable RMB Means Rising Costs Can No Longer Be Absorbed

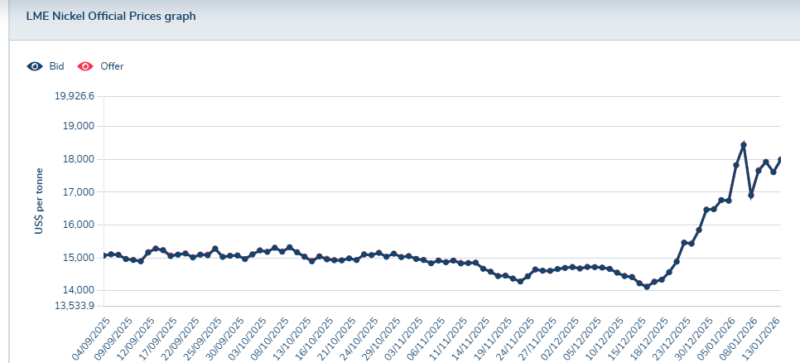

In the past, exchange rate fluctuations sometimes helped exporters absorb part of their cost pressures. When copper prices, energy costs, or labor expenses increased, currency depreciation could partially offset the impact for overseas buyers.

Under China’s current policy framework, however, RMB stability takes priority. As a result, manufacturers of copper fin tubes and other heat exchanger components have far less flexibility to absorb rising costs through exchange rate movements. Any increase in raw material, processing, or compliance costs is therefore more likely to be reflected directly in export pricing.

For global buyers, this represents a fundamental shift in how China-origin industrial product prices are formed.

Export Tax Rebate Cancellations from Q2

At the same time, another major policy change is approaching. From Q2, many product categories across multiple manufacturing industries are expected to see the cancellation or reduction of export tax rebates.

Export tax rebates have long been an important mechanism supporting China’s export competitiveness, including for industrial products such as finned tubes and heat exchanger tubes. By partially offsetting VAT and other tax burdens, these rebates helped manufacturers maintain competitive pricing in global markets.

Once these rebates are removed, exporters will face a structurally higher cost base. Unlike raw material price fluctuations, tax policy changes tend to have long-term effects, making it increasingly difficult for manufacturers to absorb the additional burden internally.

Why Prices of Finned Tubes and Heat Exchanger Tubes Will Rise Gradually

Despite these pressures, most Chinese manufacturers are unlikely to raise prices abruptly. The reality of global competition, long-term customer relationships, and ongoing projects encourages a cautious and phased approach to pricing adjustments.

In practice, price increases for copper fin tubes, finned tubes, and related heat exchanger tubes are more likely to be introduced gradually—through updated quotations, new contracts, or future orders—rather than sudden changes to existing agreements.

However, the overall direction is clear. As production costs rise and policy support decreases, the long-term pricing trend for these products is expected to move upward.

Implications for Global Buyers of Heat Exchanger Tubes

For overseas buyers sourcing heat exchanger tubes and finned tubes from China, these developments highlight the importance of proactive planning. While a stable RMB reduces currency risk, policy-driven cost increases require early communication and realistic budgeting.

International buyers may consider:

- Locking in pricing earlier for long-term HVAC or energy projects

- Discussing copper price exposure and cost structures with suppliers

- Focusing more on quality consistency, heat transfer performance, and delivery reliability rather than lowest unit price

Suppliers that can offer stable quality, predictable lead times, and technical support will be better positioned to maintain strong partnerships during this transition period.

A More Mature and Sustainable Export Environment

From a broader perspective, these policy changes reflect the continued maturation of China’s export economy. Instead of relying on currency adjustments or tax incentives, competitiveness is increasingly driven by manufacturing capability, process control, and engineering expertise.

In sectors such as industrial finned tubes and heat exchanger manufacturing, this shift favors companies that invest in equipment, quality systems, and long-term customer relationships—benefiting both manufacturers and global buyers.

Cufin Tube: A Reliable Manufacturer of Finned Tubes in a Changing Market

In an environment shaped by a stable RMB policy and rising structural costs, manufacturers with strong fundamentals are better positioned to support global customers. Cufin Tube remains committed to a long-term, sustainable manufacturing strategy.

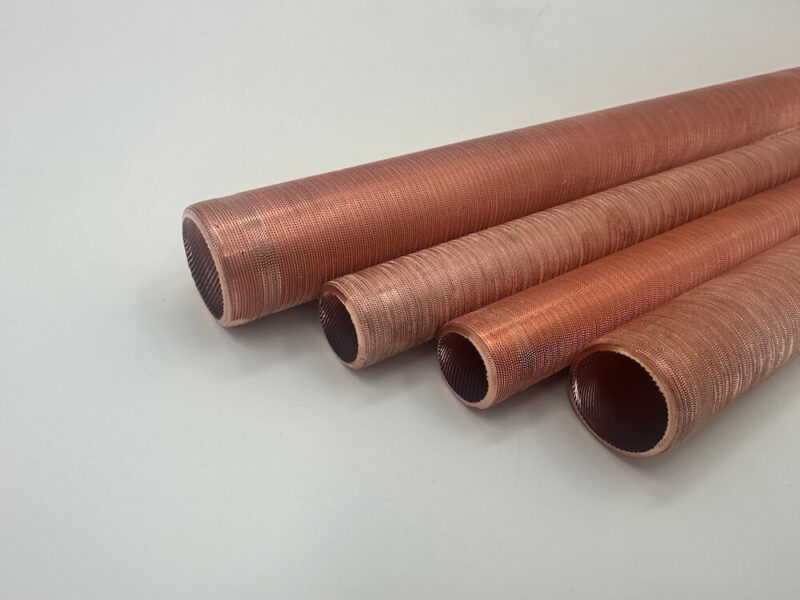

With decades of experience specializing in finned tubes, copper fin tubes, and heat exchanger tubes, Cufin Tube focuses on production stability, material optimization, and strict quality management. The company serves customers across HVAC, energy, oil & gas, and industrial heat exchanger applications.

Rather than competing solely on short-term price advantages, Cufin Tube prioritizes consistent quality, technical expertise, and transparent communication—helping international customers navigate changing market conditions with confidence.

Conclusion

China’s reaffirmed RMB stability policy, combined with upcoming export tax rebate cancellations, signals a clear and structural trend: prices of many Chinese-made industrial products—including finned tubes and heat exchanger tubes—are likely to rise gradually in the coming months.

For global buyers, understanding these changes early is essential for effective sourcing and project planning. For manufacturers, building trust through quality consistency, transparent communication, and reliable delivery will define long-term success.

As global trade conditions evolve, companies that adapt proactively—and partner with experienced manufacturers like Cufin Tube—will be best positioned to succeed.