Why Copper Prices Keep Rising: Causes, Trends, and What Industrial Buyers Should Do

Copper prices have been rising aggressively in recent years, and for many industrial buyers, this trend has become a serious operational challenge rather than a temporary market fluctuation.

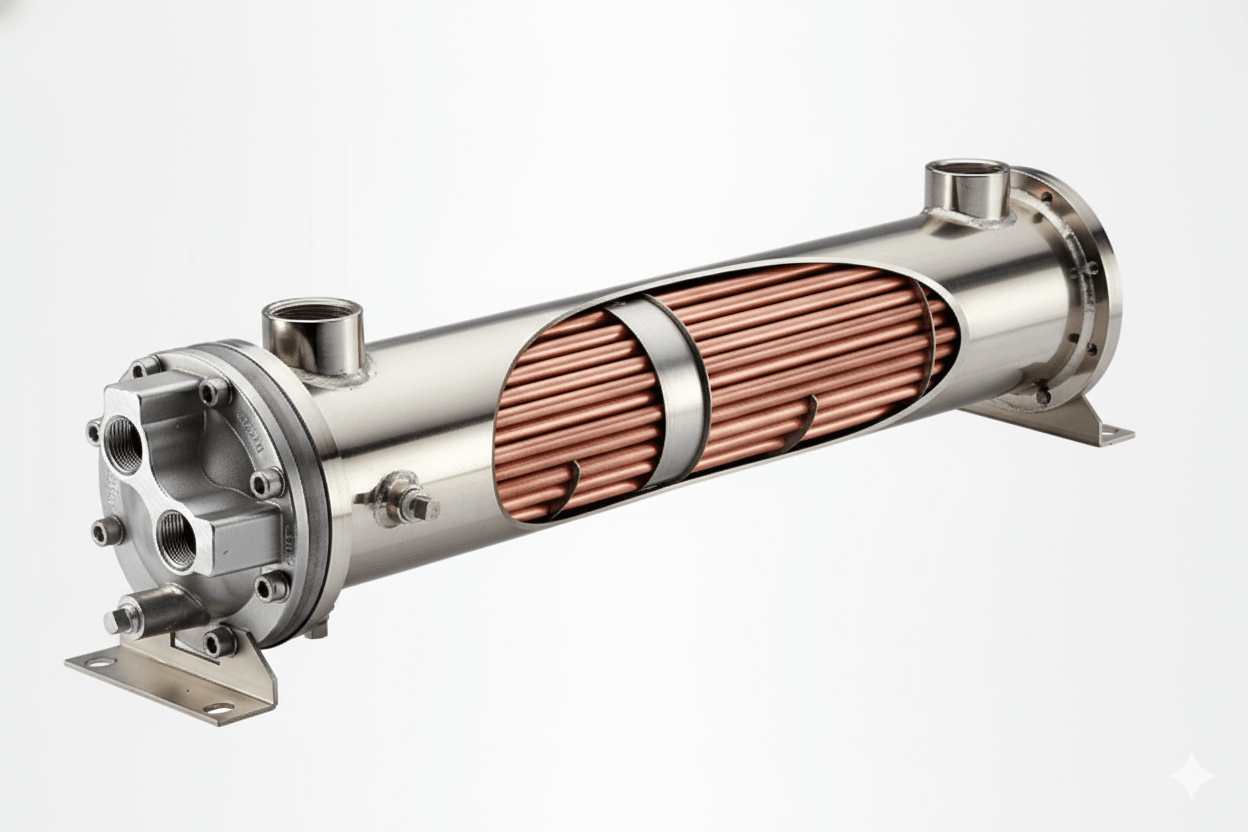

From heat exchangers and HVAC systems to power generation and mining equipment, copper is a critical raw material. When its price keeps climbing, the impact is felt across supply chains, project timelines, and profit margins.

So why are copper prices continuously rising? And more importantly, what does this mean for manufacturers and B2B buyers who rely on copper-based products such as copper finned tubes?

This article looks beyond headlines and explains the real, structural reasons behind copper’s sustained price increase — and how industrial companies can respond strategically.

- Copper Demand Is Being Driven by Long-Term Global Trends

One of the biggest reasons copper prices keep rising is that demand is no longer purely cyclical. Instead, it is being driven by long-term structural changes in the global economy.

Key demand drivers include:

- Renewable energy systems such as solar, wind, and hydropower

- Electric vehicles and EV charging infrastructure

- Power grid expansion and modernization

- Data centers and high-density energy consumption

- Industrial electrification and energy efficiency upgrades

An electric vehicle requires significantly more copper than a conventional vehicle, while renewable energy installations are even more copper-intensive. These industries are expanding globally and are strongly supported by government policies and long-term investment plans.

As a result, copper demand remains strong even during economic slowdowns, putting sustained upward pressure on prices.

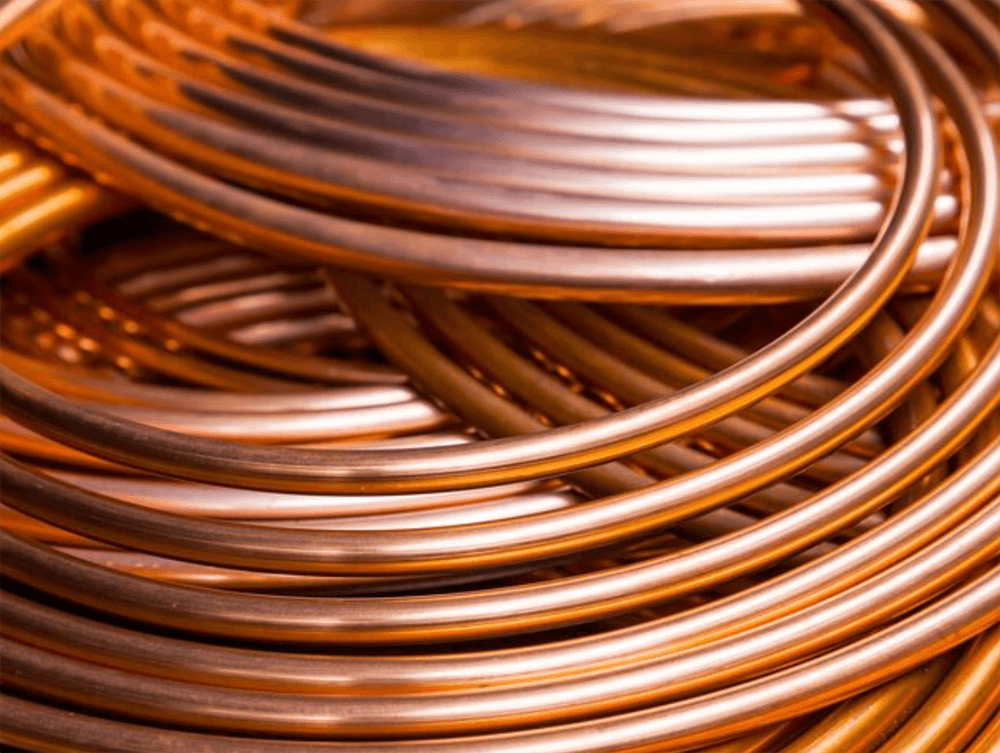

- Copper Supply Cannot Expand Fast Enough

While demand continues to grow, copper supply is facing serious constraints.

Developing a new copper mine is a long and complex process that can take 10 to 15 years. Environmental regulations, political uncertainty, labor shortages, and declining ore grades all make it difficult to increase production quickly.

In addition:

- Many existing copper mines are aging

- Ore quality is decreasing, increasing production costs

- Supply disruptions are more frequent

This imbalance between slow supply growth and strong demand means that copper prices are supported at a higher level for longer periods, rather than falling back quickly.

- Energy and Production Costs Are Embedded in Copper Prices

Copper production is highly energy-intensive. Mining, smelting, refining, and tube manufacturing all rely on stable and affordable energy supplies.

When energy costs rise — due to geopolitical tensions, carbon policies, or fuel price volatility — copper prices rise with them. Even if raw material availability remains stable, the cost floor of copper continues to move upward.

This explains why copper prices often rise rapidly but correct only slightly, making long-term cost planning increasingly difficult for industrial buyers.

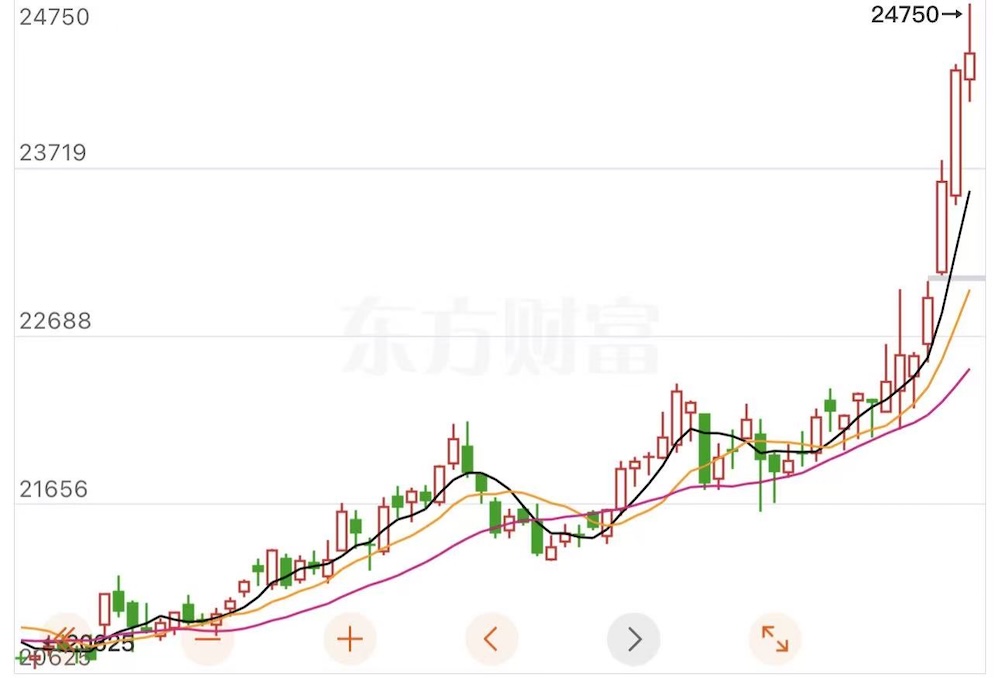

- Financial Markets Amplify Copper Price Volatility

Copper is no longer viewed only as an industrial metal. It has become a strategic commodity for investors.

Institutional funds, hedge funds, and financial institutions use copper as a hedge against inflation and as a proxy for global industrial growth. This financial participation increases volatility and can push prices higher and faster than traditional supply-demand fundamentals alone would suggest.

For manufacturers and buyers, this means that copper price movements are less predictable and more persistent.

- Impact of Rising Copper Prices on Industrial Buyers

For companies purchasing copper finned tubes, condenser tubes, and heat exchanger components, rising copper prices create several challenges:

- Shorter quotation validity periods

- Budget uncertainty for long-term projects

- Increased pressure on procurement and production planning

- Delayed projects due to material cost concerns

Trying to time the market or waiting for copper prices to “come down” often leads to missed opportunities and production delays. In today’s environment, price volatility must be managed, not avoided.

- A Smarter Procurement Strategy in a High Copper Price Market

Leading industrial companies are shifting their focus from short-term price advantages to long-term supply stability. Key priorities now include:

- Consistent product quality regardless of price fluctuations

- Transparent material pricing mechanisms

- Reliable delivery schedules

- Strong technical support and communication

- Suppliers with deep manufacturing experience

In high-value industrial applications, predictability and reliability often matter more than small price differences.

How CufinTube Supports B2B Customers in a Volatile Copper Market

At CufinTube, we understand that rising copper prices are a reality — not a temporary anomaly. As a professional manufacturer of copper finned tubes and heat exchanger tubing solutions, our focus is not simply on selling copper finned tubes, but on helping B2B customers maintain stability in an uncertain market.

With manufacturing experience dating back to 1984, we support industrial clients by offering:

- Stable and consistent tube quality, even during raw material price fluctuations

- Clear and transparent pricing communication, reducing uncertainty for buyers

- Process-controlled production, ensuring reliability for long-term projects

- Application-oriented solutions for heat exchangers, condensers, evaporators, and industrial cooling systems

For industries such as HVAC, mining, power generation, and industrial heat exchange, controlling risk is just as important as controlling cost. The right supplier does not eliminate market volatility — they help customers navigate it with confidence.

In a market where copper prices are likely to remain high, partnering with an experienced, solution-driven manufacturer can make the difference between constant disruption and long-term operational stability.